[TL;DR Expect recession in late 2023/2024]

Inflation

Inflation seem to be in a declining trend, but we must consider the lag effect for inflation indices. The CPI (consumer price index) is released around 2 weeks after the end of each month, but the Federal Reserve relies on the PCE (personal consumption expenditures price index) which is released around 4 weeks after the end of each month. Moreover, it takes time for central banks to fully conclude on the effect of their monetary policy as it can take up a year to multiple years to determine the full impact on inflation.

Inflation is also made up of different components in the economy. One huge component that is often volatile is energy prices (oil prices). Oil prices and supply are very complex topics that rely heavily on geopolitics. In 2023 we may see persistent fluctuations due to tensions between Eastern and Western countries.

Monetary Theory

Milton Friedman: 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory, and the complexity of stabilization policy

“Taxation without representation”

Stagflation

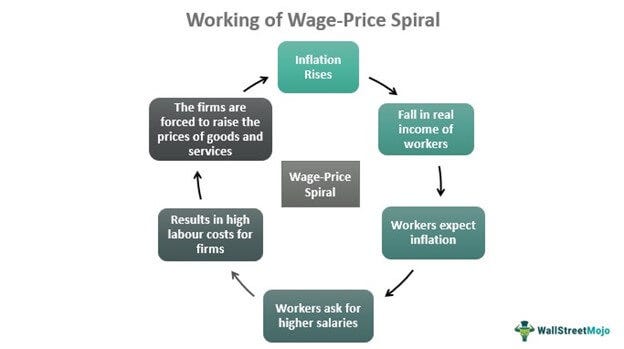

Inflationary & Deflationary Spirals

Paul Volker

“Jerome Powell Isn’t Paul Volcker, And This Isn’t 1982” (Aug 19, 2022)

The Reserve Currency

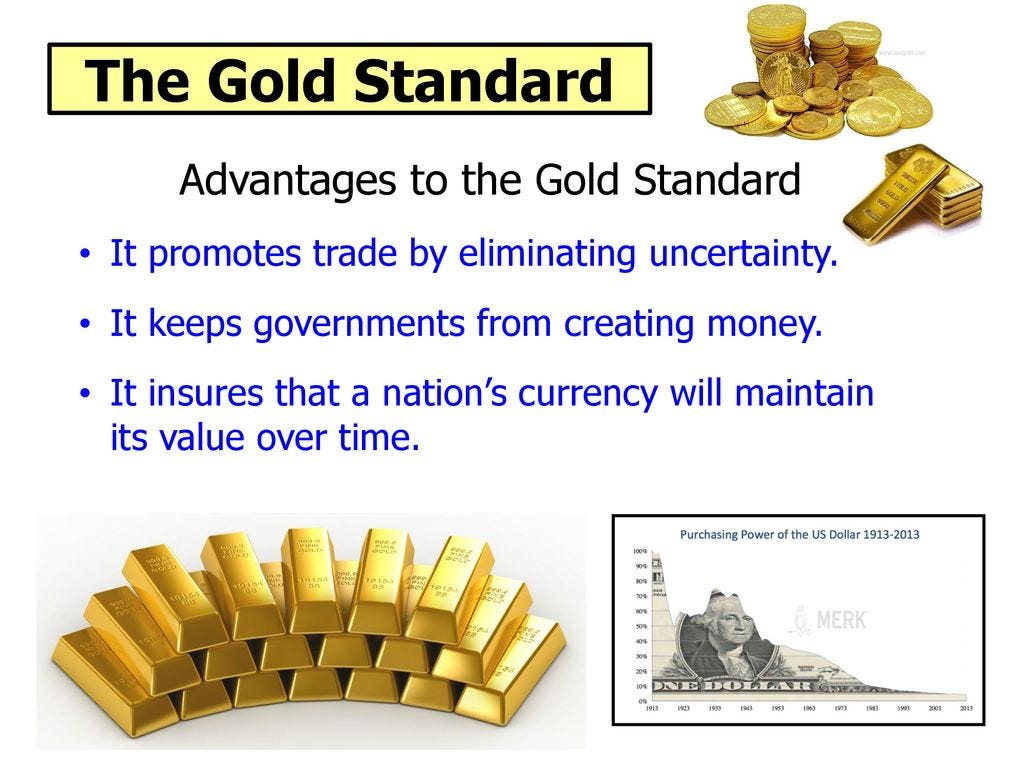

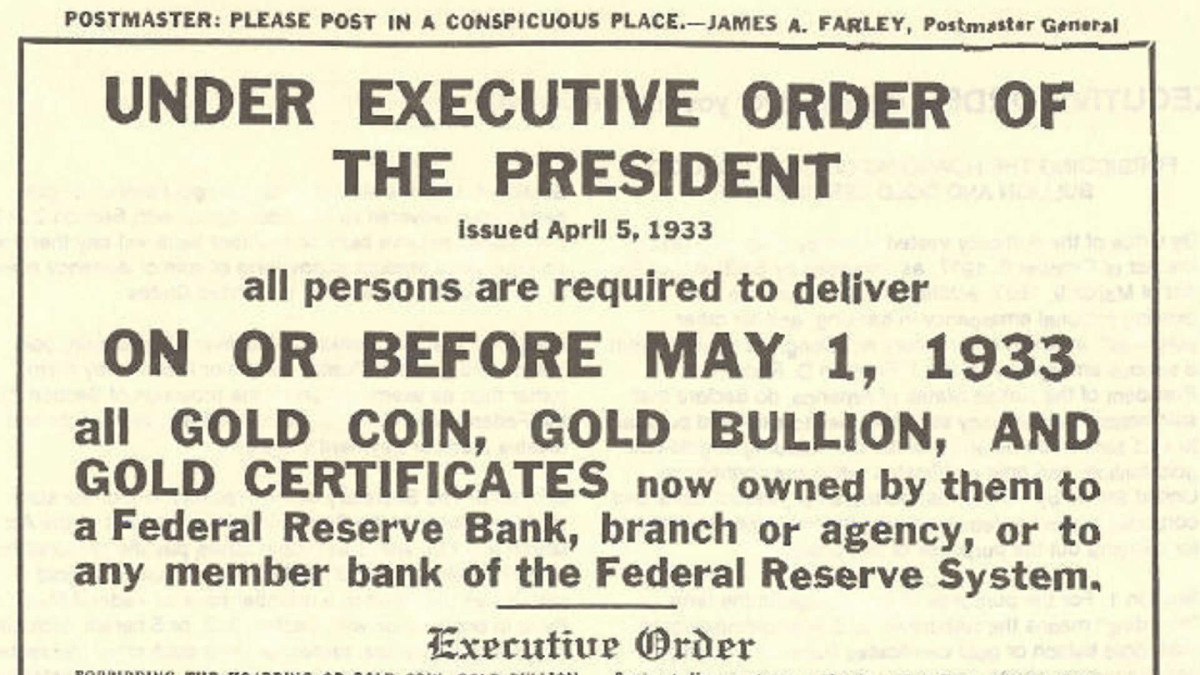

The Gold Standard

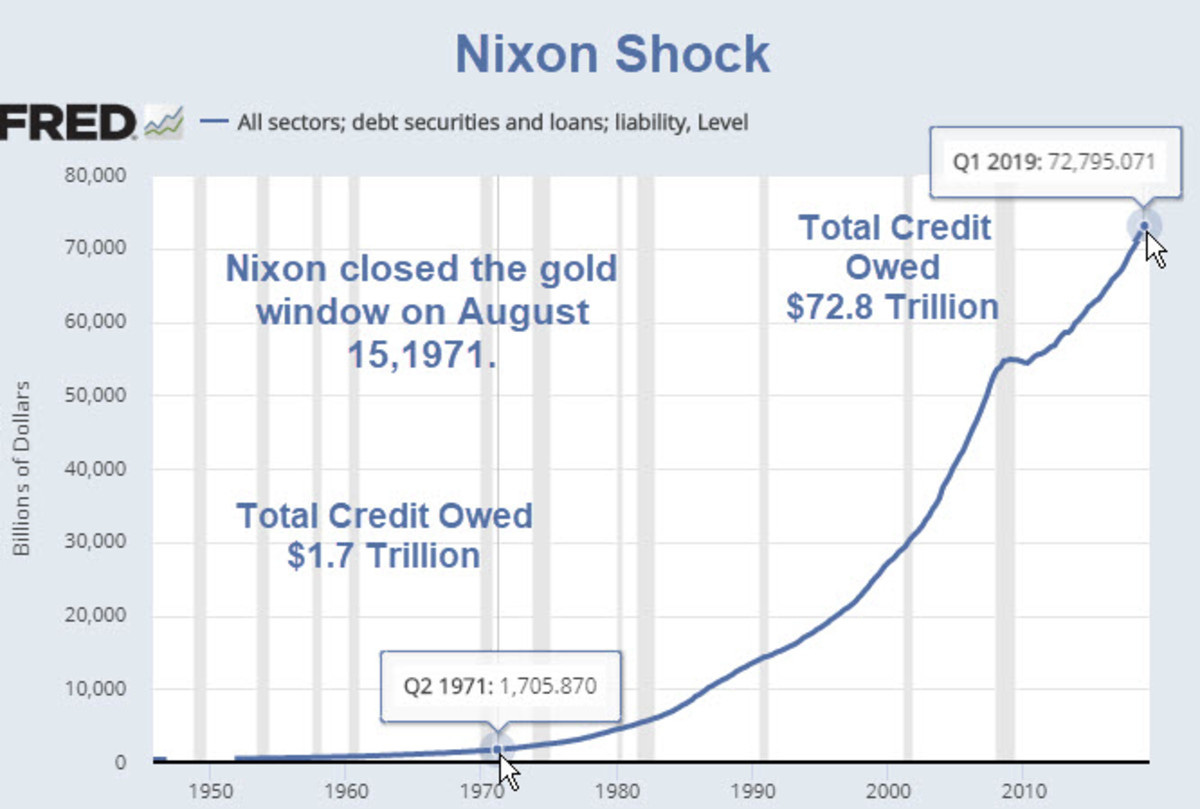

Nixon Shock

“Nixon Shock, the Reserve Currency Curse, and a Pending Currency Crisis” (Sept 30, 2019)

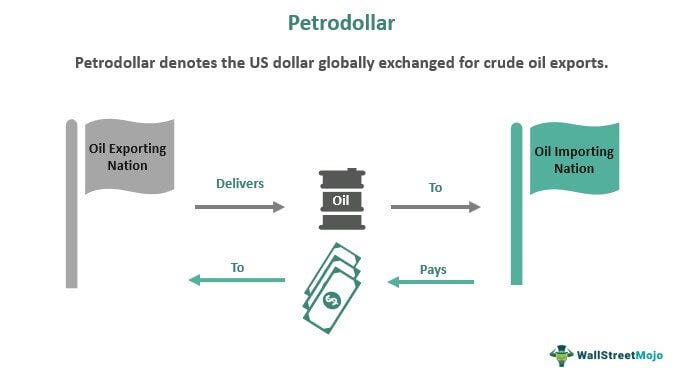

Petrodollars

China’s Ambitions

“Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales” (March 15, 2022)

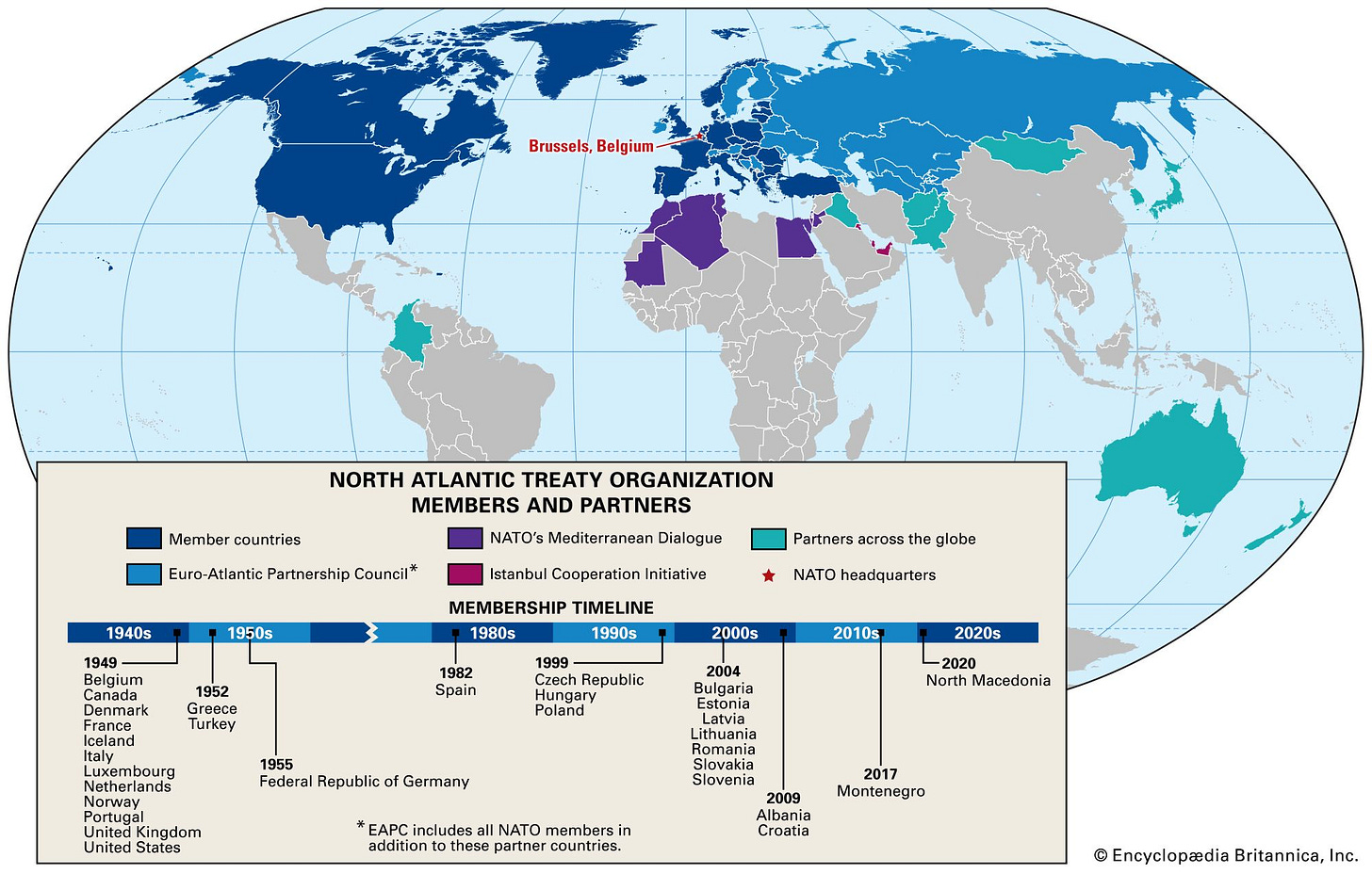

The Current World Order

The G7

US, Japan, Germany, France, UK, Italy, Canada

BRICS

Brazil, Russia, India, China, South Africa

Unemployment

GDP

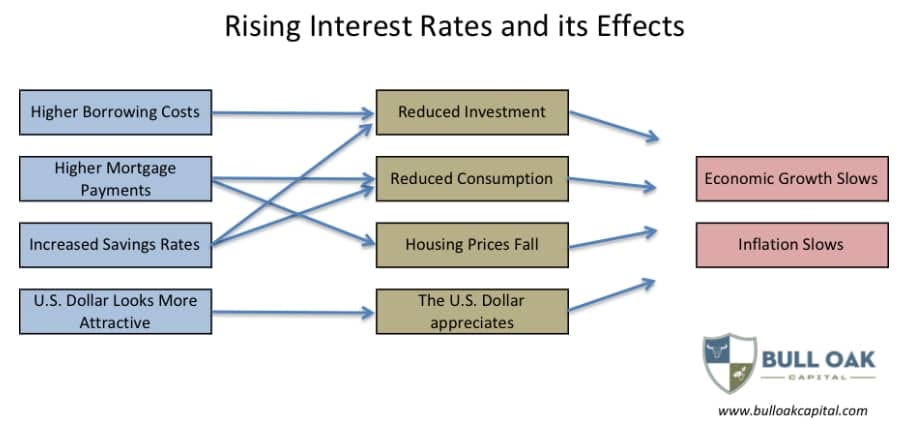

Interest Rates

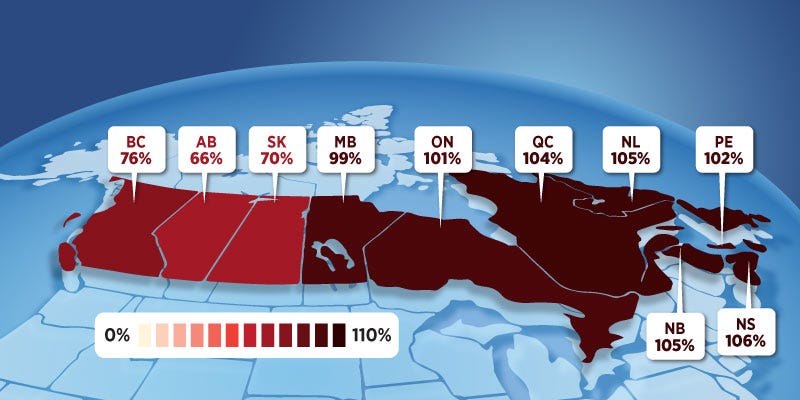

Debt

Defaults

As interest rates rise the amount owing on your debt such as a mortgage or car loan will increase, given it is a variable rate. This can lead to people being unable to make their payments, especially if interest rates rise quickly.

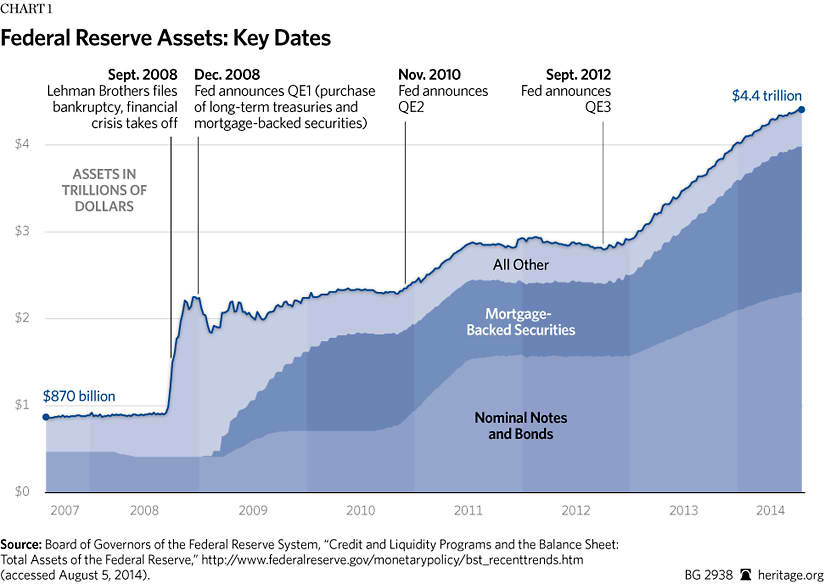

The 2008 mortgage crisis was a result of many debts being unable to be paid. An over-leveraged housing market led to the debt bubble collapsing taking out a few banks, leading to mass unemployment, and damaging the economy. However, the economy survived due to government measures where the biggest banks were given bailouts. This is despite the problem lying in the CDOs (collateralized debt obligations) and MBS (mortgage backed securities) that the banks themselves fabricated. These big banks were simply “too big to fail” as their demise would lead to catastrophic economic damage.

Quantitative Easing

These bailouts were done in the form of QE. QE has been extensively used in the 21st century and is a relatively new form of monetary policy. Economics is a rapidly developing discipline and policymakers are playing an educated guessing. QE’s long term consequences will still have to be observed. One thing is for certain, the USD is being devalued at aggressive rates.

This is where the US reserve currency role particularly comes in hand. The Federal Reserve can always print more USD and bail the US economy out of a default crisis. This of course has other consequences like devaluing currency, and in the long run the reputation of US foreign investment will fall. All forms of debt are devalued as the USD loses purchasing power. However, the US economy can go on relatively unscathed to a point.

Opinions

Jerome Powell

This is the one guy you need to listen to. His decisions determine the course of the US central bank and therefore the US economy: the world’s largest economy by nominal GDP and one which all other nation’s economies rely on.

FOMC (Federal Open Market Commitee) Schedule 2023:

March 15-16

May 3-4

June 14-15

July 26-27

Sept 20-21

Nov 1-2

Dec 13-14

Link to meetings

https://www.youtube.com/@federalreserve/streams

Bill Gross

Warren Buffett

Bear markets, inflation & interest rates

Missing the forest for the trees

→ 3 simple variables for a company: management, future economics of the business & industry, and the current price

Jumping over 7 foot bars

→ Difficult predictions of the market are usually disastrous.

→ Simple ideas = exceptional results

Shrinking your universe of possibilities

→ Opportunities are restricted in niches

→ One spot does not yield all the fish

Staying active all the time

→ You have an unlimited number of strikes

→ Wait for the ‘fat pitch’

Diversifying too much

→ “If you really know businesses, you probably should know 6 of them. I mean if you can identify 6 wonderful businesses that is all the diversification you need and you’re gonna make a lot of money, and I guarantee you going into a 7th one rather than your 1st one is gonna be a terrible mistake…”

Confirmation bias

→ Have opposing views to compare & contrast

Following the herd

→ The broad consensus of investors is almost always wrong

Error of omission

Definition: a mistake that consists of not doing something you should have done

Charlie Munger

“I’ve had my Berkshire stock decline by 50% 3 times and it doesn’t bother me that much.“

“Success and failure. Treat those 2 imposters just the same… you just roll with, sometimes its going for you, some against. It’s all part of the same game.“

“…we’ve had this since the dawn of capitalism. We’ve had crazy bubbles.“

“You don’t need all this damn diversification. You’re lucky if you have 4 assets.”

“If you have 1 or 2 (buying) opportunities a year. That’s plenty.”

“We want to buy something that’s intrinsically a very good business. Meaning that an idiot could run it and it would do alright. And then we we want that business that an idiot could run with a wonderful person running it… and now we do make some exceptions but not many… if it won’t stand a little mismanagement it’s not much of a business…”

Ray Dalio

“Now an interest rate that is high enough to deal with inflation, is too high of an interest rate for the debtor, and the dominos are falling in a very very classic way.“

Michael Burry

Cathie Wood

She has been pointing out over the last half of 2022 that commodity prices are starting to decline and level out. This gives us early indicators that inflation is starting to peak and decline, but we will have to watch more indicators over time to confidently determine this.

Elon Musk

“We have some insight into where prices are headed over time, and the interesting thing we’re seeing now is that now most of our commodities, more than half, the prices are trending down… which suggests we are past peak inflation. Now making macroeconomic prognostications is a recipe for disaster, but my guess is that we are past peak inflation and we will have a relatively mild recession, just guessing here, but you know a mild recession for 18 months would be my best guess right now.”

Link to his answer

https://www.youtube.com/live/49e7LrxS3FQ?feature=share&t=2725

Macro Twitter

Personal Remarks

The value investor will tell you that recessions don’t matter and that is generally true.

“Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.”

(Peter Lynch - legendary investor)

The long term trend is that stocks always go up. What matters is that you spend time in the market through DCA (dollar-cost averaging). The value investor mindset has some fundamentals.

Long term mindset: 10+ years

Emotional composure

Patience

Buffett gives some great advice at his shareholder meetings on keeping things simple yet effective.

Over-diversification exists

Pick 3 growing & dominating industries

examples: renewable energy economy, semiconductors, mRNA

He continues to say that this strategy will beat most indices or mutual funds. I have some additional points that could build on these fundamentals.

Pick the monopoly and/or most likely to succeed

Momentum trading is not a bad thing

example: sell 10% after a big price jump. buy a bit after a big price dump.

Taking advantage of option contract selling

Sell covered calls & cash secured puts for extra ROI

(financial derivatives trading is extremely complex. I will be covering this in a paid post eventually)

Don’t have complete faith in the US economy

Bitcoin has a valid investment thesis

Precious metals are a good minor allocation

I will be revealing my current top 6 companies and a comprehensive investment thesis of each in a paid post later this year. There will be detailed price analysis/targets and growth projections along with a full excel spreadsheet breaking all of this down.