[TL;DR Stock picks at the bottom]

I’m gonna be brutally honest. Transparency fosters a good discussion. My portfolio YTD (year-to-date) is down about 56%. Some of my speculative pre-revenue biotech & SPAC stocks were even down to lows of 70% from my cost-basis. My revenue-generating pre-earnings growth stocks have been pummeled too. However, my mega-cap play, TSMC (Taiwan Semiconductor Manufacturing Company), has only dipped to a maximum of 22% from my cost basis. I do not feel any FUD (fear, doubt, uncertainty) because I have CONVICTION in my picks. If anything, I feel as though I should average down more.

My Risk Tolerance

I am huge believer in the macroeconomic theory, although not stock picks, of Cathie Wood, CEO of ARK Invest. She lived and worked through multiple recessions such as the dot-com bubble and 2008 mortgage crisis. Her theory believes in disruptive technology bringing about infrastructural economic changes. For example, TVs and laptops have become significantly cheaper while providing better quality. Innovations like this bring about cheaper cost of living, cheaper input costs, and socioeconomic/cultural shifts. Right now the economy is undergoing more change than it has ever seen before. From renewable energy to big data AI analytics, it is a time of rapid development.

Additionally, all of my stock picks have something called a “first mover advantage”. This means that the company is the leader in the emerging industry and will in all likelihood get to market first. Which means that company will start generating revenue faster, and eventually profit, becoming a viable growing business. Moreover, these “first movers” almost always have considerable tech moats that set itself apart from competitors trying to catch up.

Catalysts

Positive

Supply chain growth

Back-ordered supply coming in now into next year

Growing protective/domestic infrastructural investment

Innovation & automation

Helping lower input costs for certain goods & services

Thereby bringing the costs of goods & services down

US Federal Reserve

Let’s all pray J Pow saves us

Negative

Increasing central interest rates

Borrowed money becomes more expensive

Discounted cash flow

Inflationary pressures

Oil price staying high/political instability/energy dependence

Input/energy costs getting high

Purchasing power decreasing, especially for non-USD

Food costs getting high as a result

Increasing demand/supply chain shortages

Hard to keep up with current rate of demand growth

Stagnating GDP? (bottlenecks)

Anti-globalization sentiments from some nations

Potential Outcomes

Price Stability

Stagflation

Real Recession

Summary

This is not the time for speculative plays. Increasing central interest rates have made money more expensive to borrow and is discounting cash flow on future earnings. Real estate will continue to fall as mortgages become less attractive. Strong financials like revenue growth, increasing profitability, increasing assets, and decreasing debt will attract safe money. Mega-caps have always been my favorite pick no matter the state of the market. The money snowball effect and walled gardens of Big Tech keep the firms hardy.

P.S. I wouldn’t touch crypto for awhile. Keep an eye out on Monero and GameFi from AAA studios.

High Watch

USD: It is a precarious time right now. Good to have cash on hand

TSLA: $600 and below (now $200 and below: 1 to 3 stock split)

In 2021 Tesla delivered almost 1,000,000 vehicles

Giga Berlin & Giga Texas recently opened

Chip like factory lay-outs (compact, flow-through)

Each factory adds about 500,000 vehicles a year

Plans to build more Gigafactories

Cybertruck enters production next year

Semi & Roadster supposedly coming soon

DTC (direct to consumer) business model/replace dealerships

Proprietary service shops & charging stations worldwide

Proprietary insurance services/AI safety monitoring score

Teach drivers to be safer/reduce their insurance bill

Aggressive vertical integration: materials in, products out

Advanced manufacturing engineering & innovation

Automated & simplified processes

Leading computer vision/steady progress on FSD

Proprietary AI training chips

Once FSD is more rigorous & regulated robo-taxis will threaten Uber & Lyft

Tesla Bot supposedly starting into next year

Home energy products stalling likely due to supply constraints

Commercial storage solutions installed worldwide

P/E around 100 (high, but extreme growth phase)

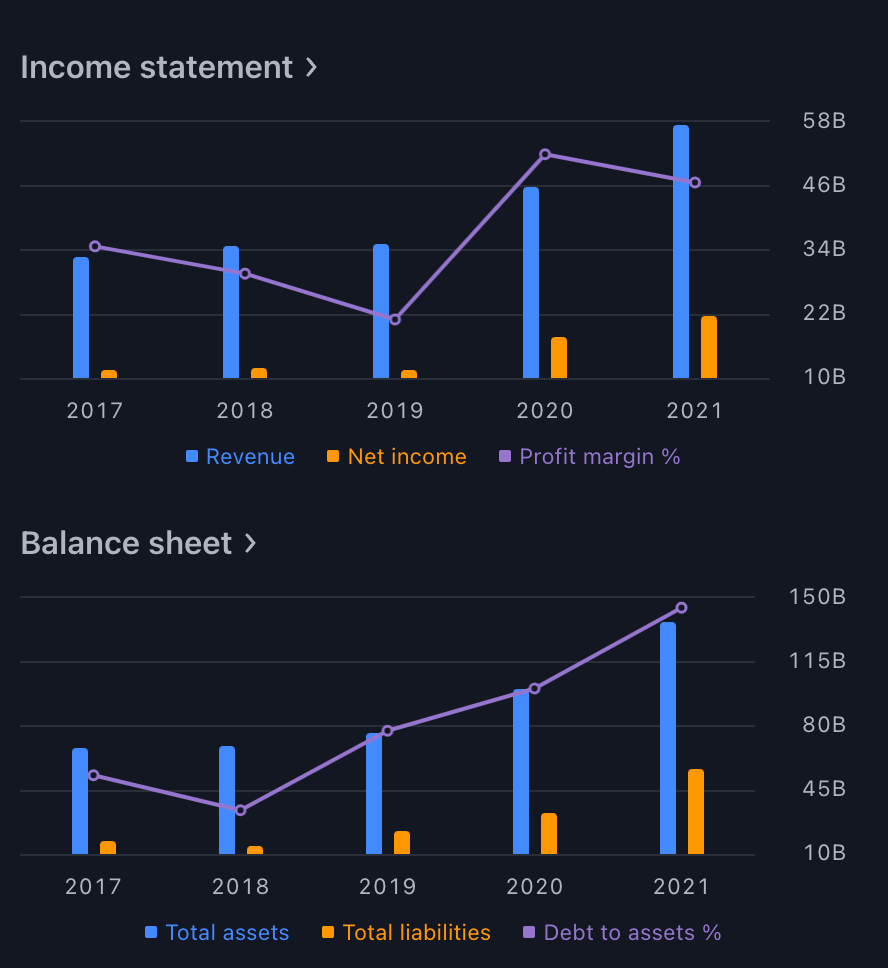

TSM: $80 and below

Pure monopoly on semiconductor fabrication

Clients include Apple, Microsoft, Google, Nvidia, AMD, Intel, Amazon, Facebook

Only single competitor is Samsung

Huge investments in new factories in US & Taiwan

P/E around 20

ASML: $500 and below

Pure monopoly on EUV lithography

No other way to make 5nm chips & smaller

Barrier to entry/R&D costs make it impossible to compete

Clients include TSMC & Samsung

P/E around 35

GOOGL: $2000 and below (now $100 and below: 1 to 20 stock split)

P/E around 20

AAPL: $125 and below

Apple is Apple

Insane walled garden

Apple Car?

P/E around 20

VALE: $12 and below

Direct deal with TSLA to mine nickel ore

Global leader in iron ore

Dividend up to 17% now

P/E around 4

DCA (dollar-cost averaging)

“Time in the market beats timing the market”

(average in)

Ideally, if you can, buy these stocks in regular intervals. Yes, buying during dips and ideal price points is awesome, but no one really knows if the stocks gonna up, down, left, right or implode. Instead, take a portion of every paycheck and invest it into the positions you believe in.

(average out)

As prices rise realize that it is an inherent risk as your profit accumulates. Once it gets to target price levels start selling off portions of your positions. Depending on your level of conviction in these positions sell accordingly. For a company like GOOGL I may honestly never ever sell my shares.